Summary

The nominal GDP growth for the next financial year has been pegged at 10.5 per cent against the 11 per cent estimated earlier

New Delhi: Continuing on the fiscally prudent path, the Modi government in the interim Budget refrained from announcing populist measures, which will help it trim the fiscal deficit to 5.1 per cent of the GDP next fiscal and 4.5 per cent in FY26.

The nominal GDP growth for the next financial year has been pegged at 10.5 per cent against the 11 per cent estimated earlier.

The nominal GDP for BE 2024-25 has been projected at Rs 3,27,71,808 crore, assuming 10.5 per cent growth over the estimated nominal GDP of Rs 2,96,57,745 crore, as per the First Advance Estimates of FY2023-24.

Helped by an improvement in tax buoyancy, the government managed to achieve a fiscal deficit of 5.8 per cent against the budget estimate of 5.9 per cent for the current financial year.

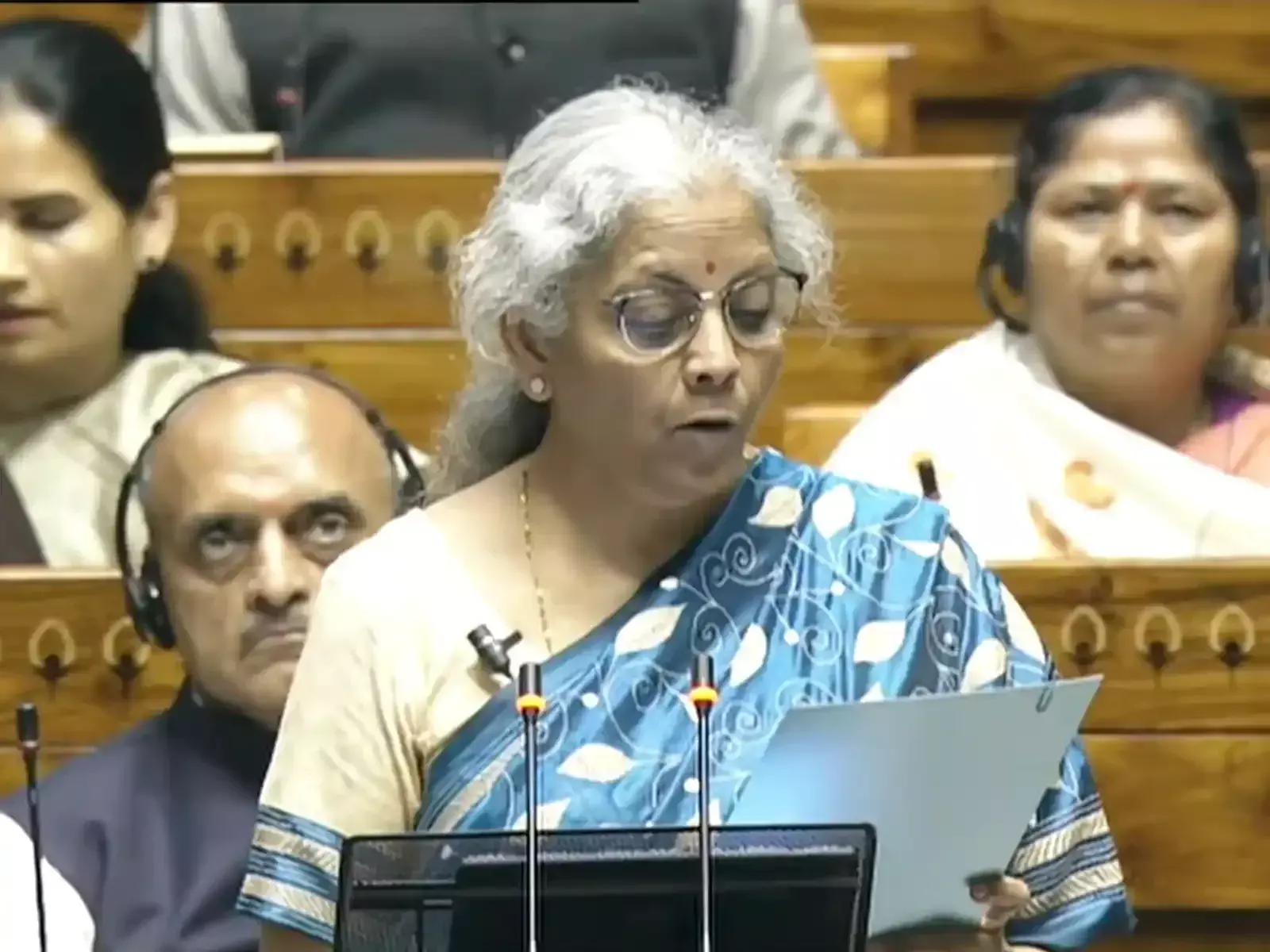

Presenting the interim Budget 2024-25, Finance Minister Nirmala Sitharaman refrained from providing any tax relief or announcing other populist measures before general elections due in the next couple of months.

"The Revised Estimate of the fiscal deficit is 5.8 per cent of GDP, improving on the Budget Estimate, notwithstanding moderation in the nominal growth estimates," she said while unveiling the interim Budget 2024-25.

As per the Fiscal Responsibility & Budget Management (FRBM) Act, the government plans to achieve a fiscal deficit of 4.5 per cent in 2025-26.

"We continue on the path of fiscal consolidation, as announced in my Budget Speech for 2021-22, to reduce fiscal deficit below 4.5 per cent by 2025-26. The fiscal deficit in 2024-25 is estimated to be 5.1 per cent of GDP, adhering to that path," she said.

In absolute terms, the fiscal deficit would be Rs 16,85,494 crore against Rs 17,34,773 crore for the current fiscal.

At the same, the effective revenue deficit would be 1.8 per cent in the current financial year and 0.8 per cent in the next financial year.

Revenue Deficit (RD) refers to the excess of revenue expenditure over revenue receipts. Effective Revenue Deficit (ERD) is the difference between a Revenue Deficit and a Grant-in-Aid for Creation of Capital Assets.

To meet the fiscal deficit, the gap between revenue receipt and expenditure, the government raises funds by issuing bonds in the market.

"The gross and net market borrowings through dated securities during 2024-25 are estimated at Rs 14.13 lakh and Rs 11.75 lakh crore respectively. Both will be less than that in 2023-24. Now, that the private investments are happening at scale, the lower borrowings by the Central Government will facilitate larger availability of credit for the private sector," she said.

Learn & Earn

Learn & Earn  Home

Home