28 Feb 2023 1:30 PM IST

Summary

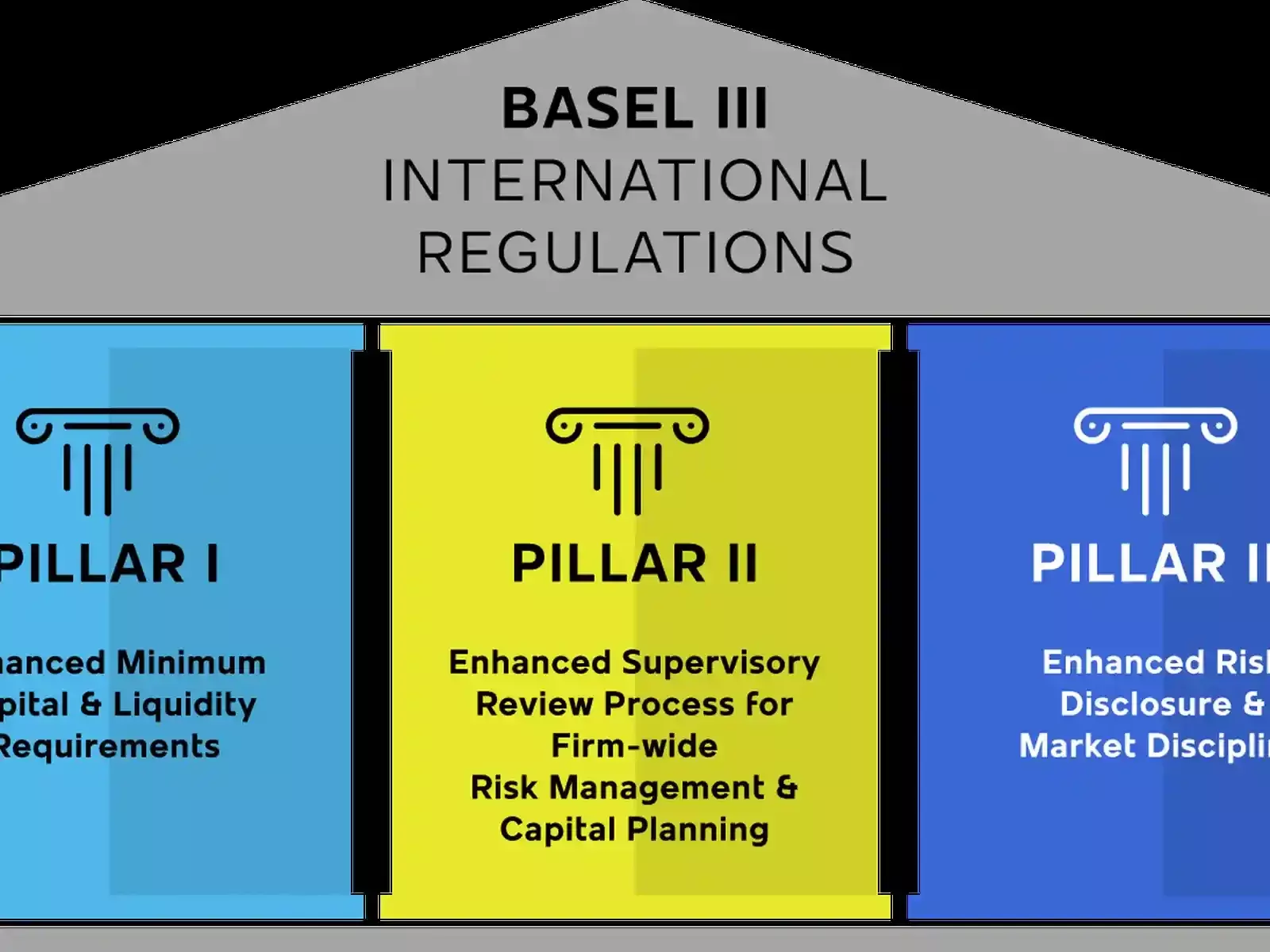

Minimum capital requirements, supervisory review, and market discipline are the three pillars of Basel III.

Basel III, an extension of Basel II, is an international set of measures to promote stability developed in response to the financial crisis of 2007-09, by the Basel Committee on Banking Supervision. It is a comprehensive set of reform measures aimed to decrease the damage done to the economy that has taken too much risk aiming to strengthen the regulation, transparency, supervision, and risk management of the banks.

It required the banks to maintain certain leverage ratios keeping certain levels of reserve capital on hand. Minimum capital requirements, supervisory review, and market discipline are the three pillars of Basel III.

Basel III introduced capital buffers like Capital Conservation Buffer, Countercyclical Capital Buffer, Higher Common Equity Tier 1 (CET1), and Minimum Total Capital Ratio. It also introduced two liquidity ratios:

—Liquidity Coverage Ratio (LCR)

—Net Stable Funding Ratio (NSFR)

The RBI released a draft framework on October 22, 2021 on master directions to implement the Basel III Capital Framework for All India Financial Institutions (AIFIs) including EXIM Bank, NABARD, NHB, and SIDBI.

The draft directions propose minimum capital ratio of 11.5 per cent of total risk weighted assets (RWA). They also propose AIFIs to maintain a capital conservation buffer in the form of common equity at 2.5 per cent of RWA, in addition to the minimum capital adequacy ratio of 9 per cent. These Basel III norms are in line with the minimum capital ratio of 11.5 per cent and minimum capital adequacy ratio of 9 per cent followed by Indian banks.

The draft regulations proposed raising common equity in tier-1 capital to 5.5 per cent of RWA and proposed the minimum tier-1 capital at 7 per cen. The captial conservation buffer is proposed at 2.5 per cent. Capital distribution constraints will be imposed on an AIFI when capital level falls within this range. However, they will be able to conduct business as normal when their capital levels fall into the conservation range.

Common equity consists of paid-up equity capital, share premium, statutory reserves, capital reserves, and other disclosed free reserves. According to RBI, the AIFIs shall implement all three pillars of Basel III captial regulations, considering their role in the Indian financial system. AIFIs are required to maintain a minimum pillar 1 capital to RWA (CRAR) of 9 per cent on an on-going basis other than capital conservation buffer and counter-cyclical captial buffer.

Learn & Earn

Learn & Earn  Home

Home