27 April 2023 1:00 PM IST

Summary

Assets under management stood at Rs.3,07,339 crore

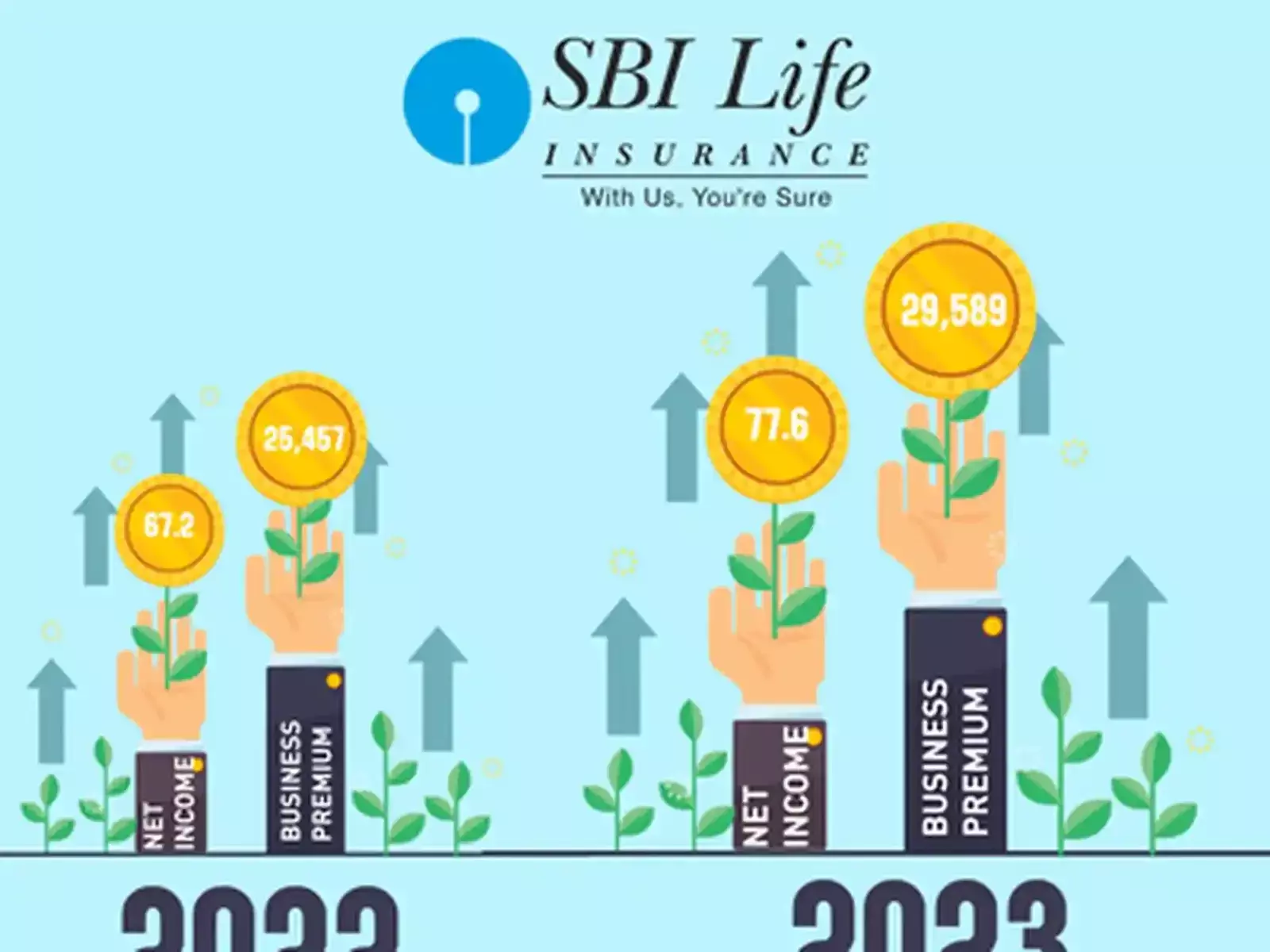

SBI Life on Wednesday reported Rs 77.6 crore net income for the March quarter, marginally up from the Rs 67.2 crore it had booked in the 12 trailing months, despite higher premium and margins.

The largest private sector life insurer in an exchange filing said its first-year premium inched up to Rs 408.9 crore from Rs 385.3 crore, and renewal premium rose to Rs 398.6 crore from Rs 281.2 crore, of which single premium income increased to Rs 1,989.6 crore from Rs 1,743.3 crore during the reporting quarter.

The bottom line was impacted by the massive fall in investment income, which came down to Rs 118.6 crore from Rs 299.9 crore in the year-ago period, the company informed the exchanges. It was also impacted by higher expenses, which rose to Rs 95.8 crore from Rs 87.2 crore.

However, the official press release did not offer any quarterly numbers.

For the full year, its new business premium rose to Rs 29,589 crore from Rs 25,457 crore in March 2022, boosted by regular premium, which increased 17 per cent. For the year, it earned a net income of Rs 1,721 crore.

Protection business rose 19 per cent to Rs 3,636 crore and individual new business premium rose 27 per cent to Rs 20,906 crore.

The company's solvency ratio stood at 2.15x as against the regulatory requirement of 1.50x.

The value of new business grew 37 per cent to Rs 5,067 crore, with a robust margin of 30.1 per cent, up 420 bps for the year.

Assets under management stood at Rs 3,07,339 crore as of March-end, the company said.

Learn & Earn

Learn & Earn  Home

Home